WPP Reports 6.9% Q2 Revenue Growth, But A Decline In Tech Spending Is Causing Headwinds

The world’s biggest advertising group, WPP, has downgraded its full-year like-for-like growth forecast to 1.5-3 per cent from 3-5 per cent after lower spending from tech clients caused its revenue in North America to decline in the months from May through June.

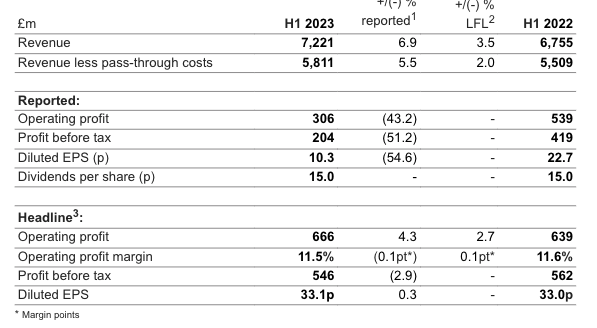

Reporting its 2Q numbers, the London-based holding company said its first-half profit before tax had halved to £204 million, which it blamed on lower revenues in the US from technology clients.

Highlights of the Q2 numbers included:

- H1 reported revenue +6.9 per cent, LFL revenue +3.5 per cent (Q2 +2.3 per cent)

- H1 revenue less pass-through costs +5.5 per cent, LFL revenue less pass-through costs +2 per cent (Q2 +1.3 per cent)

- In Q2, ex-US growth accelerated to mid-single digits, with China growing albeit less strongly than expected. North America declined in Q2, primarily due to lower revenues from technology clients

- H1 headline operating profit margin 11.5 per cent, down 0.1pt, and on a constant FX basis improved by 0.1pt. Efficiency benefits offset by investment in IT and higher severance costs

- Trade working capital favourable movement of £165m year-on-year. Non-trade working capital adverse movement of £316m

- Adjusted net debt at 30 June 2023 £3.5bn, up £0.3bn year-on-year, £0.4bn lower than Q1 2023. Expect year end net debt to be flat year-on-year

WPP CEO Mark Read commented: “Our performance in the first half has been resilient with Q2 growth accelerating in all regions except the USA, which was impacted in the second quarter by lower spending from technology clients and some delays in technology-related projects. This was felt primarily in our integrated creative agencies. China returned to growth in the second quarter albeit more slowly than expected. In the near term, we expect the pattern of activity in the first half to continue into the second half of the year.

“Our media business, GroupM, grew consistently across the first six months as did our businesses in the UK, Europe, Latin America and Asia-Pacific. Client spending in consumer packaged goods, financial services and healthcare remained good and, despite short-term challenges, our technology clients represent an important driver of long-term growth. Our agencies performed extremely well at the Cannes Lions Festival winning five Grand Prix and 165 Lions with Mindshare recognised as the most-awarded media agency. We won major new business assignments with clients including: Reckitt, Mondelēz, easyJet, Lloyds Banking Group, Pernod Ricard and India’s second largest advertiser, Maruti Suzuki.”

Read added: “We have exciting future plans in AI that build on our acquisition of Satalia in 2021 and our use of AI across WPP. We are leveraging our efforts with partnerships with the leading players including Adobe, Google, IBM, Microsoft, Nvidia and OpenAI. We are delivering work powered by AI for many clients including Nestlé, Nike and Mondelēz. AI will be fundamental to WPP’s future success and we are committed to embracing it to drive long-term growth and value.”

Latest News

X Defends Record On Removing Child Abuse Content As It Promises A Safer Environment For Advertisers

Two execs from X, the social media site formerly known as Twitter, have defended owner Elon Musk’s (pictured) decision to reinstate accounts that shared child abuse material on the app. Musk reinstated the account of American far-right influencer Dominick McGee who had shared a video produced by convicted Australian paedophile Peter Gerard Scully of a […]

Thursday TV Ratings: Seven Just Beats Nine With The Chase Coming Out Top

Is there a study into the correlation between Thursday's diminished TV numbers & the increased sale of pub schnitzels?

Indie Agency Communicado Raids Thinkerbell For Its Two New Associate Creative Directors

Thinkerbell duo depart for rival agency Communicado. Leaving speeches were said to be convivial but restrained.

“Utterly Irresponsible!” Sportsbet Slammed For Near-$20m Marketing Blitz As Gambling Ban Approaches

Smokers have been picked on for 30 years, now it's time for the gamblers. And the drinkers should start getting nervous.

Casella Appoints Dig As Creative Agency On Yellow Tail Wine

There's three givens at B&T's Friday staff drinks - the Yellow Tail, the Cheezels and the incessant bickering.

Seven Prioritises The Matildas Over The News AND The AFL In Extraordinary Decision Ahead Of The Women’s World Cup Quarter Final

Scott and Charlene's wedding now under serious threat as Saturday's Matilda's game threatens to smash all TV records.

News Corp Earnings Down Across The Board Despite Jump In Subscribers

Rupert can't find a coin for his ALDI trolley as News Corp earnings drop calls for renewed round of belt tightening.

Despite The Outrage & The Bans, The Sports Bet Category Remains Adland’s Zaniest (See This!)

The Guardian may no longer be running sports bet advertising, but as you'll read here, B&T has far less morals & ethics.

Last Chance To Buy Tickets For This Year’s B&T Women In Media Awards!

B&T's not giving away too many secrets to the Women In Media Awards suffice to say two words - chocolate and fountain.

The Trade Desk, Magnite & LiveRamp Deliver Growth, PubMatic Flat In Q2 Earnings

B&T's calling this your Q2 earnings wrap. We even considered wheeling out "must read" to help it along a bit.

Cinema Chain Spoofs Classic Movies In Wonderfully Funny Work To Entice People Back Into Theatres

Call it the Barbenheimer effect, but cinema's suddenly cool again. Yet, absolutely no uptick whatsoever for drive-ins.

Mediabrands Launches Internship Program For Aspiring Media Professionals

Mediabrands are on the lookout for young, enthusiastic go-getters for its internship program. But then, aren't we all?

Nike Celebrates The Matildas & Young Aussie Female Athletes In New Work By Conscious Minds

In what can be best described as a rare treat, it's a localised Nike ad. Kinda like finding the milk's not out of date.

Why Your CX Technology Should Focus On Connections

This expert opines it's not about your newfangled tech stacks, it's about your customers. Even the ones you detest.

WPP & Optimizely Partner To Bring Informed Digital Experiences To Brands & Consumers

Often think WPP's a 'canary in the coal mine' for industry trends? Well, avoid the black lung reading this latest.

Dylan Alcott & Hnry Team Up To Relieve Aussie Sole Traders Of Scary Tax Admin

Can the effervescent Dylan Alcott make tax admin even remotely interesting? Watch as he gives his best shot here.

D&AD Shift With Google Sydney Announce Class Of 2023

Need to poach some hot young agency talent? Poach away here, but just don't rat on B&T for the heads up.

Digital Media Agency Bench Rebrands To The Digital Disruption Agency

You could say Bench has been benched, as agency rebrands to the Digital Disruption Agency.

Seven Appoints Indie Creative Agency Emotive To Reshape Broadcaster’s Brand

Seven planning a brand zjoosh and spring clean. Although the offical corporate red and the number 7 is off limits.

Elon Musk Says The ABC Prefers “Censorship-Friendly” Social Media

It appears the ABC's found a new enemy in Elon Musk. However, News Corp remains entrenched at the top of the enemy list.

Wednesday TV Ratings: The Chase Just Beats The Block To Entertainment Win

Nine wins Wednesday night. However, Seven tells rival you'll get that and more come Saturday's Matilda's match.

B&T’s Best Of The Best Technologists, Presented By Finecast, Part Of GroupM Nexus

Somewhat ironically, this top 10 technologists list wasn't written with any help from ChatGPT or AI whatsoever!

Former Woman’s Day Editor Fiona Connolly Appointed Head of News’ Lifestyle Network

You could say ink runs in the veins of women's magazine veteran Fiona Connolly. And sponge cake recipes.

X Adds Brand Safety Tools In Bid To Bring Back Ad Dollars

Elon back contemplating the colonisation of Mars after finding this whole Twitter thing one huge headache.

ACMA Rules Kyle Sandilands’ Monkeypox Comments Breached Decency Rules And Were Offensive To Gay Men

Watchdog rules Kyle offended gay men. Punishment includes listening to Barbra Streisand & Céline Dion CDs on repeat.

Ozzy Osborne Bites Off More Than He Can Chew With Banned PlayStation Ad

Ozzy Osborne continuing to surprise. No more so than the fact that he's actually still alive and kicking.

Swisse Wellness Wheels In the Celebs To Stop Late Night Doom Scrollers

Is your sleep routine two Quaaludes and a swig from the sherry bottle? There's tips here for a more blissful night.

“All Good Things Must Come To An End, Well This One Barely Got started!” Jerker Fagerström Quits Thinkerbell After Eight Months

Thinkerbell fridge sans all smörgåstårta & pickled herring as Jerker Fagerström heads for the utgång (exits).

Footballing God Cristiano Ronaldo Bumbles His Way through New Work For Fan App Zuju

This ad proves Cristiano Ronaldo is just one of the guys. Just a filthy rich one of the guys, that is.

Samsung Ads’ Marj Hetherton On Why CTV Is The Most Exciting Area Of Advertising

Samsung Ads' Marj Hetherton says CTV is the most exciting area of advertising. That and nine-hour client lunches.

CommBank Matildas REMOVES Tim Tam TikTok Following B&T Story

If Tim Tam's marketing team wants to send B&T some freebies for this free press we'll take any flavour but mint or dark.

Tinder’s New Global Campaign Says Online Dating Need Not Be An Unrivalled Hell

If there were truth in advertising, these spots would feature a drunk bloke with poor hygiene who lives with his mother.

ADMA Adds New Speakers For Upcoming Global Forum

ADMA confirms speaker line-up for upcoming Global Forum. Also, 300 arancini balls locked-in for the networking drinks.

IMAA Census Predicts Growth In BVOD/CTV, Digital Video And Podcasts

The IMAA census is like a finger on the pulse of Australia's adland. And we all need a solid finger now and then.

Prestige Brands Targets Gen Z With Racy Billie Eilish Perfume Ad Via Spark Foundry

Billie Eilish the latest celeb to release a fragrance. Meanwhile, B&T still waiting on an Angus Young eau de toilette.

The Australian Women’s Weekly Celebrates Its 90th Birthday

The Weekly celebrates its 90 birthday. B&T believes the first-ever copy is still in our GP's reception.