VOZ Is Having A Slower Than Expected Impact On Media Spend With Industry Waiting On ‘Gold Standard’

It’s been three months since OzTam first released VOZ. Designed to eventually replace the metro overnight figures, VOZ combines Broadcast TV and BVOD audiences into one dataset. So are the new figures having any impact on ad spend?

Key Takeaways

● VOZ is helping agencies to allocate spend but change is slower than expected

● The measurement is particularly useful when it comes to reaching certain demographics

● It is helping to ‘hold’ TV spend with Networks using VOZ and additional software to demonstrate BVOD uptick

Change Is Slower Than Expected

Whilst there is no doubt that VOZ is becoming increasingly involved in conversations around ad spend, change is slow.

So far it’s “not having a major impact on spending decisions,” Chris Walton, managing director at Nunn Media, told B&T.

“This is due to a combination of factors – how viewing currency is split, which demos we are buying, what environmental factors we are focussed on,” he said.

He did add, however, that this is not negative and that he has “no doubt in my mind it will have a bigger impact in time.”

Lorraine Woods, national head of trading at Atomic 212°, agreed – “ we haven’t seen a lot of change yet,”she said.

“We’re working through different demographics that we can target, and we are in discussion with Oztam about streamlining them.”

“We’re still waiting for the third party software suppliers to be certified gold standard. And once that comes through, it definitely will be a game changer. But at this stage, it’s still all for planning & buying purposes”.

Chris Walton, Nunn Media

Having An Impact On The Demos

Despite change being slow, VOZ is helping to improve media allocation as well as the quality of conversations, Woods said.

“We see a lot of benefit of it within our teams particularly with finding out what the optimal spend levels are and where we should be allocating this”.

“It allows us to have better conversations, optimise our campaigns, and try and determine the right budgets that should be allocated to both of those channels based on audience insights”.

Additional software can be a very useful tool when it comes to the broadcast industry using VOZ figures to justify ad spend, Steve Allen, director of strategy and research at Pearman media said.

“We’re buying more and more BVOD and our clients are asking more and more questions about BVOD.”

“We purchase software which allows us to join up broadcast television plus BVOD and see what the whole schedule is. We can see on our campaigns what BVOD is adding in reach and it is a considerable amount, about 12 per cent on average.”

This is only true for schedules with “reasonable” schedules, not “nickels and dimes”.

Streaming Is Often More Popular With Younger Demos

Helping To Hold TV Spend

TV networks have been quick to pick up on the figures, Allen said, adding that the new measurements have been a good way to keep media spend within TV.

“I attended a presentation about six weeks ago where the Seven Network came in and demonstrated the same point”.

“They demonstrated across four or five different target audiences how much BVOD adds in reach and it’s considerable”.

Whilst it isn’t necessarily leading to an increase in TV spend, Allen said, it was certainly helping to “hold” TV spend.

Like Woods, Allen agrees that VOZ can be particularly useful when it comes to trying to efficiently reach a certain demographic.

“We had a client who only spent their money on BVOD. But that was a computer game client. All they wanted was gamers.”

Going to the BVOD channels was “considerably more efficient” because of the “segmentation tools on those platforms”.

“We could basically specifically target viewers who are gamers”.

BVOD can be a great way to target special groups such as gamers

What is the future for VOZ?

Despite the slow progress, buyers are generally hugely positive about VOZ and the impact that it will have on the media industry.

“It’s such a fundamental shift to how we have previously been able to plan and measure television and video audiences. So I think if anything, it’s only going to get better from here,” Woods said.

Walton agreed that VOZ being launched has provided a benchmark that buyers can use to measure the success of BVOD.

May the 1st marked the start of a transition period for the industry to become accustomed to the VOZ data and be ready to transact on VOZ. The goal is for VOZ to become trading currency in the calendar year 2024.

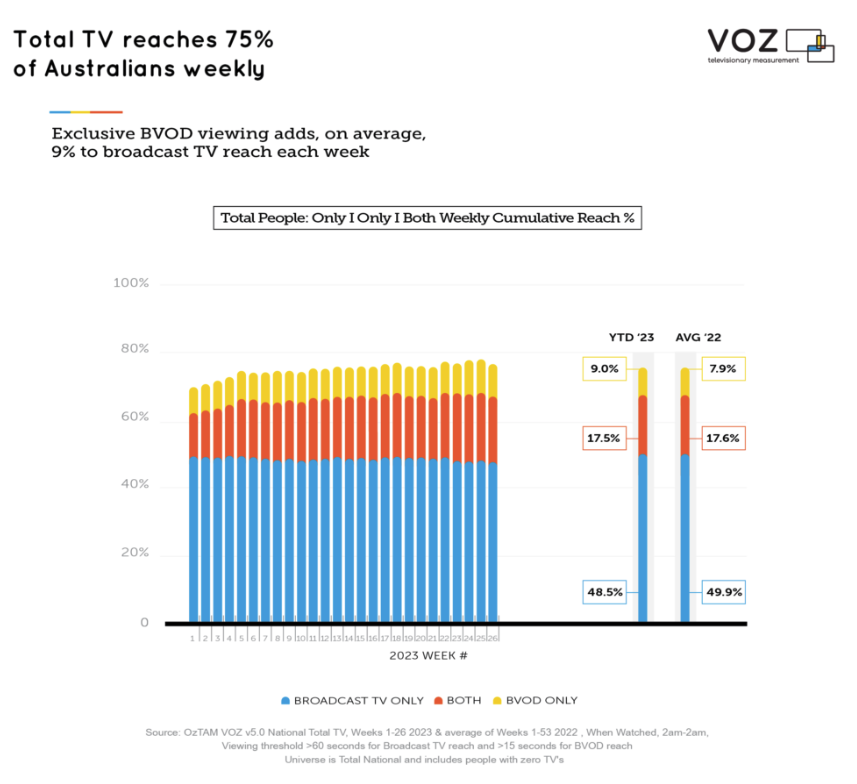

Speaking to B&T, a spokesperson said: we’re in the transition period working across the industry to educate and enable VOZ adoption. Key to this is the in-progress Gold Standard implementation and accreditation activities with the Third-Party Software Suppliers (TPSSes) whose tools facilitate media planning, trading and reporting activities. We’re seeing enthusiasm across the industry to realise the benefits VOZ offers, in particular incremental BVOD Reach as evidenced in our insights here. For instance, the chart below:

Source: OzTam

Please login with linkedin to comment

Latest News

X Defends Record On Removing Child Abuse Content As It Promises A Safer Environment For Advertisers

B&T warns this article references the murky & sordid world of online child abuse. Plus, the murky & sordid Elon Musk.

Thursday TV Ratings: Seven Just Beats Nine With The Chase Coming Out Top

Is there a study into the correlation between Thursday's diminished TV numbers & the increased sale of pub schnitzels?

Indie Agency Communicado Raids Thinkerbell For Its Two New Associate Creative Directors

Thinkerbell duo depart for rival agency Communicado. Leaving speeches were said to be convivial but restrained.

“Utterly Irresponsible!” Sportsbet Slammed For Near-$20m Marketing Blitz As Gambling Ban Approaches

Smokers have been picked on for 30 years, now it's time for the gamblers. And the drinkers should start getting nervous.

Casella Appoints Dig As Creative Agency On Yellow Tail Wine

There's three givens at B&T's Friday staff drinks - the Yellow Tail, the Cheezels and the incessant bickering.

Seven Prioritises The Matildas Over The News AND The AFL In Extraordinary Decision Ahead Of The Women’s World Cup Quarter Final

Scott and Charlene's wedding now under serious threat as Saturday's Matilda's game threatens to smash all TV records.

News Corp Earnings Down Across The Board Despite Jump In Subscribers

Rupert can't find a coin for his ALDI trolley as News Corp earnings drop calls for renewed round of belt tightening.

Despite The Outrage & The Bans, The Sports Bet Category Remains Adland’s Zaniest (See This!)

The Guardian may no longer be running sports bet advertising, but as you'll read here, B&T has far less morals & ethics.

Last Chance To Buy Tickets For This Year’s B&T Women In Media Awards!

B&T's not giving away too many secrets to the Women In Media Awards suffice to say two words - chocolate and fountain.

The Trade Desk, Magnite & LiveRamp Deliver Growth, PubMatic Flat In Q2 Earnings

B&T's calling this your Q2 earnings wrap. We even considered wheeling out "must read" to help it along a bit.

Cinema Chain Spoofs Classic Movies In Wonderfully Funny Work To Entice People Back Into Theatres

Call it the Barbenheimer effect, but cinema's suddenly cool again. Yet, absolutely no uptick whatsoever for drive-ins.

Mediabrands Launches Internship Program For Aspiring Media Professionals

Mediabrands are on the lookout for young, enthusiastic go-getters for its internship program. But then, aren't we all?

Nike Celebrates The Matildas & Young Aussie Female Athletes In New Work By Conscious Minds

In what can be best described as a rare treat, it's a localised Nike ad. Kinda like finding the milk's not out of date.

Why Your CX Technology Should Focus On Connections

This expert opines it's not about your newfangled tech stacks, it's about your customers. Even the ones you detest.

WPP & Optimizely Partner To Bring Informed Digital Experiences To Brands & Consumers

Often think WPP's a 'canary in the coal mine' for industry trends? Well, avoid the black lung reading this latest.

Dylan Alcott & Hnry Team Up To Relieve Aussie Sole Traders Of Scary Tax Admin

Can the effervescent Dylan Alcott make tax admin even remotely interesting? Watch as he gives his best shot here.

D&AD Shift With Google Sydney Announce Class Of 2023

Need to poach some hot young agency talent? Poach away here, but just don't rat on B&T for the heads up.

Digital Media Agency Bench Rebrands To The Digital Disruption Agency

You could say Bench has been benched, as agency rebrands to the Digital Disruption Agency.

Seven Appoints Indie Creative Agency Emotive To Reshape Broadcaster’s Brand

Seven planning a brand zjoosh and spring clean. Although the offical corporate red and the number 7 is off limits.

Elon Musk Says The ABC Prefers “Censorship-Friendly” Social Media

It appears the ABC's found a new enemy in Elon Musk. However, News Corp remains entrenched at the top of the enemy list.

Wednesday TV Ratings: The Chase Just Beats The Block To Entertainment Win

Nine wins Wednesday night. However, Seven tells rival you'll get that and more come Saturday's Matilda's match.

B&T’s Best Of The Best Technologists, Presented By Finecast, Part Of GroupM Nexus

Somewhat ironically, this top 10 technologists list wasn't written with any help from ChatGPT or AI whatsoever!

Former Woman’s Day Editor Fiona Connolly Appointed Head of News’ Lifestyle Network

You could say ink runs in the veins of women's magazine veteran Fiona Connolly. And sponge cake recipes.

X Adds Brand Safety Tools In Bid To Bring Back Ad Dollars

Elon back contemplating the colonisation of Mars after finding this whole Twitter thing one huge headache.

ACMA Rules Kyle Sandilands’ Monkeypox Comments Breached Decency Rules And Were Offensive To Gay Men

Watchdog rules Kyle offended gay men. Punishment includes listening to Barbra Streisand & Céline Dion CDs on repeat.

Ozzy Osborne Bites Off More Than He Can Chew With Banned PlayStation Ad

Ozzy Osborne continuing to surprise. No more so than the fact that he's actually still alive and kicking.

Swisse Wellness Wheels In the Celebs To Stop Late Night Doom Scrollers

Is your sleep routine two Quaaludes and a swig from the sherry bottle? There's tips here for a more blissful night.

“All Good Things Must Come To An End, Well This One Barely Got started!” Jerker Fagerström Quits Thinkerbell After Eight Months

Thinkerbell fridge sans all smörgåstårta & pickled herring as Jerker Fagerström heads for the utgång (exits).

Footballing God Cristiano Ronaldo Bumbles His Way through New Work For Fan App Zuju

This ad proves Cristiano Ronaldo is just one of the guys. Just a filthy rich one of the guys, that is.

Samsung Ads’ Marj Hetherton On Why CTV Is The Most Exciting Area Of Advertising

Samsung Ads' Marj Hetherton says CTV is the most exciting area of advertising. That and nine-hour client lunches.

CommBank Matildas REMOVES Tim Tam TikTok Following B&T Story

If Tim Tam's marketing team wants to send B&T some freebies for this free press we'll take any flavour but mint or dark.

Tinder’s New Global Campaign Says Online Dating Need Not Be An Unrivalled Hell

If there were truth in advertising, these spots would feature a drunk bloke with poor hygiene who lives with his mother.

ADMA Adds New Speakers For Upcoming Global Forum

ADMA confirms speaker line-up for upcoming Global Forum. Also, 300 arancini balls locked-in for the networking drinks.

IMAA Census Predicts Growth In BVOD/CTV, Digital Video And Podcasts

The IMAA census is like a finger on the pulse of Australia's adland. And we all need a solid finger now and then.

Prestige Brands Targets Gen Z With Racy Billie Eilish Perfume Ad Via Spark Foundry

Billie Eilish the latest celeb to release a fragrance. Meanwhile, B&T still waiting on an Angus Young eau de toilette.

The Australian Women’s Weekly Celebrates Its 90th Birthday

The Weekly celebrates its 90 birthday. B&T believes the first-ever copy is still in our GP's reception.