Women More Anxious About Rising Costs According To M&C Saatchi Group Research

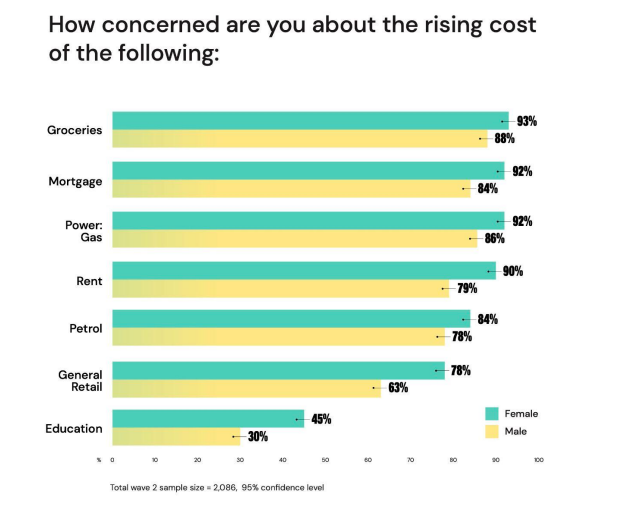

M&C Saatchi Group’s new report ‘Prioritisation, planning and promos: How Australia is learning to live with the cost of living crisis’ reveals that women are exhibiting significant concern regarding the cost of living crisis.

More than a third (36 per cent) of women feel anxious, which significantly surpasses the 20 per cent of men that responded with the same concern. This marks a four percentage point increase for women between October 2022 and May 2023. This has huge implications for brands and businesses, given women account for 85 per cent of all purchases and drive 70-80 per cent of all consumer spending.

This increased anxiety is driven by the fact women:

● Earn less on average (the national gender pay gap on base salary is 13.3 per cent)

● Carry the mental load for many purchase decisions on a daily basis

Due to the increased anxiety amongst women, M&C Saatchi Group is seeing shifts in how consumers are spending, namely the emergence of the intentional shopper. A consumer who prioritises their spend in a much more planned and deliberate way (making sacrifices to protect what they value most).

Through this proprietary study M&C Saatchi Group explored how the cost of living crisis is significantly changing shopping behaviour, focusing on six key spending trends:

1. They are going deeper into their subscriptions: cancelling streaming services they don’t need but looking deeper into the archives of the ones that they are retaining. 26 per cent of respondents will cancel one or more pay tv/streaming subscriptions in the next three to six months.

2. They are more open to substitution: we are seeing customers more likely to be open to try new brands or products, whether that be new retailers (e.g. supermarkets) or buying cheaper substitute brands like home brands.

3. They are using loyalty programs more: 24 per cent of people are using loyalty program memberships more frequently.

4. They are squeezing the last drop: They are holding onto makeup products longer (91 per cent are shopping less frequently for makeup and skin care and 90 per cent are making products last longer).

5. They are more planned: There is less spontaneity and customers are going into supermarkets with a list and not deviating off those lists.

6. They are hunting for deals: Consumers are spending more time researching products and seeking discounts. Even Gen Z are seeking discounts and coupons and sharing them with a sense of pride with their networks.

Emily Taylor, chief strategy officer at M&C Saatchi Group, said proactive brands were acting now to stay in favour with consumers: “We have seen our clients take action in this cost of living crisis to really help their customers, including innovations and utility to better plan their spending. To stay in a customer’s consideration phase, brands need to be adapting to new behaviours; less sporadic spend and more intentional, conscious consumption.”

The Report highlights key ways in which brands can help customers through the cost of living crisis. For example, given it can cost five times more to acquire a new customer than retaining an existing customer, loyalty is extremely important. The research also found that a one-size-fits all approach to brand marketing will not work in these conditions.

● 18 – 34 year olds over indexed in more payment options (eg Afterpay), loyalty programs and education and content

● 35 – 54 year olds over indexed in more payment options, loyalty and better customer service (if products/services increase in price, so do customer expectations)

● 55+ year olds are over indexed in price capping and having more certainty on prices.

Customer Quotes:

“Cutting back on expenses such as subscriptions. Eating more at home. Weekly shop at Aldi rather than Coles” Female, 40-44

“Buying more grocery homebrands and planning my shopping list better with current specials. I drive my car less and have a better plan for when I do drive. I cancelled a few monthly subscriptions which aren’t necessary. Eat less take away/restaurants.” Female, 30-34

“We’ve never had so many appointments cancelled and rebooked. People are definitely extending the time between visits” hair salon owner (Inner West Sydney).

Please login with linkedin to comment

Latest News

X Defends Record On Removing Child Abuse Content As It Promises A Safer Environment For Advertisers

B&T warns this article references the murky & sordid world of online child abuse. Plus, the murky & sordid Elon Musk.

Thursday TV Ratings: Seven Just Beats Nine With The Chase Coming Out Top

Is there a study into the correlation between Thursday's diminished TV numbers & the increased sale of pub schnitzels?

Indie Agency Communicado Raids Thinkerbell For Its Two New Associate Creative Directors

Thinkerbell duo depart for rival agency Communicado. Leaving speeches were said to be convivial but restrained.

“Utterly Irresponsible!” Sportsbet Slammed For Near-$20m Marketing Blitz As Gambling Ban Approaches

Smokers have been picked on for 30 years, now it's time for the gamblers. And the drinkers should start getting nervous.

Casella Appoints Dig As Creative Agency On Yellow Tail Wine

There's three givens at B&T's Friday staff drinks - the Yellow Tail, the Cheezels and the incessant bickering.

Seven Prioritises The Matildas Over The News AND The AFL In Extraordinary Decision Ahead Of The Women’s World Cup Quarter Final

Scott and Charlene's wedding now under serious threat as Saturday's Matilda's game threatens to smash all TV records.

News Corp Earnings Down Across The Board Despite Jump In Subscribers

Rupert can't find a coin for his ALDI trolley as News Corp earnings drop calls for renewed round of belt tightening.

Despite The Outrage & The Bans, The Sports Bet Category Remains Adland’s Zaniest (See This!)

The Guardian may no longer be running sports bet advertising, but as you'll read here, B&T has far less morals & ethics.

Last Chance To Buy Tickets For This Year’s B&T Women In Media Awards!

B&T's not giving away too many secrets to the Women In Media Awards suffice to say two words - chocolate and fountain.

The Trade Desk, Magnite & LiveRamp Deliver Growth, PubMatic Flat In Q2 Earnings

B&T's calling this your Q2 earnings wrap. We even considered wheeling out "must read" to help it along a bit.

Cinema Chain Spoofs Classic Movies In Wonderfully Funny Work To Entice People Back Into Theatres

Call it the Barbenheimer effect, but cinema's suddenly cool again. Yet, absolutely no uptick whatsoever for drive-ins.

Mediabrands Launches Internship Program For Aspiring Media Professionals

Mediabrands are on the lookout for young, enthusiastic go-getters for its internship program. But then, aren't we all?

Nike Celebrates The Matildas & Young Aussie Female Athletes In New Work By Conscious Minds

In what can be best described as a rare treat, it's a localised Nike ad. Kinda like finding the milk's not out of date.

Why Your CX Technology Should Focus On Connections

This expert opines it's not about your newfangled tech stacks, it's about your customers. Even the ones you detest.

WPP & Optimizely Partner To Bring Informed Digital Experiences To Brands & Consumers

Often think WPP's a 'canary in the coal mine' for industry trends? Well, avoid the black lung reading this latest.

Dylan Alcott & Hnry Team Up To Relieve Aussie Sole Traders Of Scary Tax Admin

Can the effervescent Dylan Alcott make tax admin even remotely interesting? Watch as he gives his best shot here.

D&AD Shift With Google Sydney Announce Class Of 2023

Need to poach some hot young agency talent? Poach away here, but just don't rat on B&T for the heads up.

Digital Media Agency Bench Rebrands To The Digital Disruption Agency

You could say Bench has been benched, as agency rebrands to the Digital Disruption Agency.

Seven Appoints Indie Creative Agency Emotive To Reshape Broadcaster’s Brand

Seven planning a brand zjoosh and spring clean. Although the offical corporate red and the number 7 is off limits.

Elon Musk Says The ABC Prefers “Censorship-Friendly” Social Media

It appears the ABC's found a new enemy in Elon Musk. However, News Corp remains entrenched at the top of the enemy list.

Wednesday TV Ratings: The Chase Just Beats The Block To Entertainment Win

Nine wins Wednesday night. However, Seven tells rival you'll get that and more come Saturday's Matilda's match.

B&T’s Best Of The Best Technologists, Presented By Finecast, Part Of GroupM Nexus

Somewhat ironically, this top 10 technologists list wasn't written with any help from ChatGPT or AI whatsoever!

Former Woman’s Day Editor Fiona Connolly Appointed Head of News’ Lifestyle Network

You could say ink runs in the veins of women's magazine veteran Fiona Connolly. And sponge cake recipes.

X Adds Brand Safety Tools In Bid To Bring Back Ad Dollars

Elon back contemplating the colonisation of Mars after finding this whole Twitter thing one huge headache.

ACMA Rules Kyle Sandilands’ Monkeypox Comments Breached Decency Rules And Were Offensive To Gay Men

Watchdog rules Kyle offended gay men. Punishment includes listening to Barbra Streisand & Céline Dion CDs on repeat.

Ozzy Osborne Bites Off More Than He Can Chew With Banned PlayStation Ad

Ozzy Osborne continuing to surprise. No more so than the fact that he's actually still alive and kicking.

Swisse Wellness Wheels In the Celebs To Stop Late Night Doom Scrollers

Is your sleep routine two Quaaludes and a swig from the sherry bottle? There's tips here for a more blissful night.

“All Good Things Must Come To An End, Well This One Barely Got started!” Jerker Fagerström Quits Thinkerbell After Eight Months

Thinkerbell fridge sans all smörgåstårta & pickled herring as Jerker Fagerström heads for the utgång (exits).

Footballing God Cristiano Ronaldo Bumbles His Way through New Work For Fan App Zuju

This ad proves Cristiano Ronaldo is just one of the guys. Just a filthy rich one of the guys, that is.

Samsung Ads’ Marj Hetherton On Why CTV Is The Most Exciting Area Of Advertising

Samsung Ads' Marj Hetherton says CTV is the most exciting area of advertising. That and nine-hour client lunches.

CommBank Matildas REMOVES Tim Tam TikTok Following B&T Story

If Tim Tam's marketing team wants to send B&T some freebies for this free press we'll take any flavour but mint or dark.

Tinder’s New Global Campaign Says Online Dating Need Not Be An Unrivalled Hell

If there were truth in advertising, these spots would feature a drunk bloke with poor hygiene who lives with his mother.

ADMA Adds New Speakers For Upcoming Global Forum

ADMA confirms speaker line-up for upcoming Global Forum. Also, 300 arancini balls locked-in for the networking drinks.

IMAA Census Predicts Growth In BVOD/CTV, Digital Video And Podcasts

The IMAA census is like a finger on the pulse of Australia's adland. And we all need a solid finger now and then.

Prestige Brands Targets Gen Z With Racy Billie Eilish Perfume Ad Via Spark Foundry

Billie Eilish the latest celeb to release a fragrance. Meanwhile, B&T still waiting on an Angus Young eau de toilette.

The Australian Women’s Weekly Celebrates Its 90th Birthday

The Weekly celebrates its 90 birthday. B&T believes the first-ever copy is still in our GP's reception.